Financial Fusion Lifetime Deal Review: Is It Worth Your Investment?. Discover if the Financial Fusion Lifetime Deal is worth your money with our honest review. Get insights that help you make smart investment choices!

What is the Financial Fusion Lifetime Deal?

The Financial Fusion Lifetime Deal offers access to a suite of financial tools. These tools cater to individuals & businesses alike. They help manage finances efficiently. Users get a one-time payment option instead of a monthly subscription. This deal is especially appealing for those looking to save costs in the long run.

With this deal, users can access features such as budgeting assistances, investment tracking, & expense management. It also includes educational resources to improve financial literacy. Overall, it aims to streamline financial planning. The deal provides significant value for a one-time investment.

Key Features of Financial Fusion Lifetime Deal

The Financial Fusion Lifetime Deal includes several notable features:

- Comprehensive budgeting tools

- Investment tracking capabilities

- Detailed expense management

- Educational resources about financial strategies

Each feature enhances the user’s financial management experience. The budgeting tools allow users to plan effectively. They can visualize their income & expenses. With investment tracking, users can monitor their portfolios effortlessly. This tracking helps in making informed decisions.

Expense management features ensure users stay within budgets. Users can categorize expenses for a clearer view. On top of that, educational resources guide users through complex financial concepts. This empowers them to make better financial choices. Each feature in this deal contributes to a holistic approach to personal finance.

Pros & Cons of Financial Fusion Lifetime Deal

| Pros | Cons |

|---|---|

| Cost-effective for long-term use | Initial investment may seem high |

| Access to valuable financial tools | Learning curve for new users |

| One-time payment eliminates monthly fees | Limited customer support options |

This table highlights the key advantages & disadvantages. The Financial Fusion Lifetime Deal proves cost-efficient over time. Users avoid recurring costs common with regular subscriptions. Access to advanced tools enhances financial control. Be that as it may, the upfront payment may deter some users.

And another thing, users may face a learning curve. It takes time to grasp all the features. Some users may find customer support lacking. Knowing these aspects helps potential buyers assess the deal better.

Comparing Financial Fusion with Other Tools

Many financial tools exist in the market today. Comparing them helps users make informed decisions. Financial Fusion stands out for its lifetime deal.

| Tool | Price | Key Features |

|---|---|---|

| Financial Fusion | One-time payment | Budgeting, Investment Tracking |

| Mint | Free with ads | Budgeting, Credit Score Tracking |

| YNAB | Monthly subscription | Budgeting, Goal Tracking |

As seen in this table, Financial Fusion offers a unique pricing model. While some tools like Mint are free, they have limitations. In a different context, tools such as YNAB require ongoing payments. Users often prefer minimizing expenses. Hence, the lifetime deal from Financial Fusion attracts many customers.

User Experience with Financial Fusion Lifetime Deal

My personal experience with the Financial Fusion Lifetime Deal has been positive. I found the budgeting tools user-friendly & effective. Setting up my budget took just a few minutes. Tracking my expenses has become a routine for me. I no longer dread checking my finances.

Investment features helped me monitor my growing portfolio. And another thing, the educational resources proved valuable. They expanded my financial knowledge significantly. The platform is intuitive, making it easy for anyone to use.

Overall, I appreciate how this tool has streamlined my financial processes. The one-time payment structure offers great value. I feel empowered to manage my finances better than before.

Investment Insights from Financial Fusion Lifetime Deal

The Financial Fusion Lifetime Deal encourages smart investments. It equips users with necessary tools to analyze their portfolios. Importantly, users can track performance across different assets. This tracking is vital for informed decision-making.

And another thing, the platform provides insights into market trends. Understanding these trends allows users to strategize effectively. The educational resources also play a crucial role here. They guide users through various investment strategies. This learning ultimately boosts financial confidence.

- Evaluate your investment goals

- Monitor market trends regularly

- Adjust your portfolio as needed

By following these steps, users maximize the benefits of the Financial Fusion platform. This facilitates better investment outcomes. Proper usage of the tools enhances overall financial health.

Creating a Budget with Financial Fusion

Using the Financial Fusion Lifetime Deal to create a budget is straightforward. First, log into the platform. From there, navigate to the budgeting tool.

Start by inputting all of your income sources. Include salaries, side jobs, & any passive income. Next, categorize your expenses. Common categories include housing, food, & entertainment. This organization simplifies tracking.

Set limits for each expense category. The tool allows users to visualize spending habits. Regularly review the budget to identify trends.

- Identify areas to cut back

- Adjust limits as your lifestyle changes

This continuous refinement keeps finances on track. The comprehensive approach aids in achieving long-term financial goals. With consistent use, users can manage their finances effectively.

Considerations Before Buying the Financial Fusion Lifetime Deal

Before committing to the Financial Fusion Lifetime Deal, consider a few factors. Evaluate the features according to your needs. Does it provide the tools you truly require?

Also, assess the cost versus long-term savings. Compare the one-time investment against monthly expenses from other platforms. This comparison helps in making a budget-friendly choice.

Lastly, consider your comfort level with technology. Users new to finance tools may need more time to adjust. The platform can seem overwhelming at first. Ensure that you are willing to invest that time in learning.

Real User Opinions on Financial Fusion Lifetime Deal

User feedback helps gauge the effectiveness of the Financial Fusion Lifetime Deal. Many users praise its comprehensiveness. They find that it covers all essential aspects of personal finance.

Several users also mention ease of use. They appreciate how quickly they can navigate the platform. And another thing, many report improved budgeting habits. Users have seen an increase in savings after using the deal.

“The Financial Fusion Lifetime Deal transformed my financial journey!” – Sarah Johnson

Be that as it may, some users express concerns. They highlight the steep learning curve for beginners. Others wish for improved customer support options. Overall, the feedback tends to be quite positive.

How to Maximize Your Financial Fusion Lifetime Deal

To get the most from the Financial Fusion Lifetime Deal, users should engage fully with the tools. Start by attending any webinars or educational sessions available. These provide valuable insights & tips.

Consistently use the budgeting tools. This habit helps strengthen your financial planning. Regularly monitor your investments & adjust your strategies based on performance.

- Set up notifications for major financial events

- Engage with the community for shared insights

On top of that, seek feedback from financial experts. Implement their advice according to your personal situation. This proactive approach leads to better financial outcomes.

Conclusion on the Value of Financial Fusion Lifetime Deal

The Financial Fusion Lifetime Deal presents itself as cost-effective. Potential users must weigh its benefits against their needs. While initial investment may seem high, the long-term savings are significant. Its comprehensive tools cater to a variety of financial requirements.

Ultimately, this tool serves as an asset for anyone wanting to enhance their financial management.

Feature of Financial Fusion

Financial Fusion offers several key features that make it a valuable tool for individuals & businesses alike. One advantage of this product is the Lifetime Access that users receive upon purchase. This access ensures that users can utilize the software without any recurring fees, providing cost-effectiveness in the long run.

Another notable feature is the inclusion of all future Essential (Tier 1) or Professional (Tier 2+) Plan updates. This means that users will always have access to the latest enhancements & innovations offered by Financial Fusion, keeping their investment relevant. Activating the license within 60 days of purchase is essential to benefit from this feature.

The ability to upgrade or downgrade between 5 license tiers allows users to select a plan that best fits their needs. There are no codes or stacking required; you simply choose the option that suits you best. This flexibility is a significant advantage for users who may want to adjust their plan as their financial requirements evolve.

- Lifetime Access upon purchase

- All future Essential or Professional Plan updates included

- License activation within 60 days

- Flexibility to upgrade or downgrade across 5 tiers

- No codes needed for plan selection

Challenges of Financial Fusion

Users may encounter several challenges when using Financial Fusion. One common issue is the limitations in features available in the lower-tier plans. Users might find that certain functions required for advanced financial management are only accessible in the higher-tier packages. This can be frustrating for those looking to utilize the software to its fullest potential without incurring additional costs.

And another thing, there may be occasional compatibility issues with other software systems. Some users have reported difficulties integrating Financial Fusion with existing tools they use for financial tracking & management. Ensuring that all systems work harmoniously is vital for maximizing the software’s potential.

The learning curve can be another challenge. While Financial Fusion has a user-friendly interface, some users might find it takes time to navigate all the features effectively. Feedback shows that initial guidance, such as tutorials or onboarding sessions, could greatly assist users in becoming proficient with the software. Suggestions for implementation include utilizing webinars or video tutorials that can simplify the learning process.

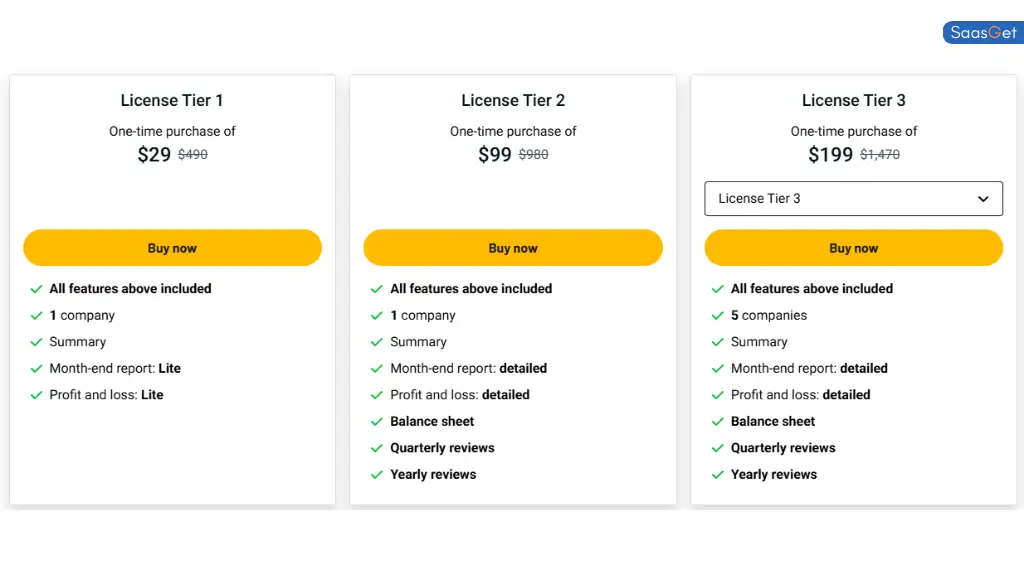

Price of Financial Fusion

The pricing structure for Financial Fusion is designed to cater to various needs, allowing users to choose according to their requirements. Here’s a breakdown of the different license tiers & their prices:

| License Tier | Price |

|---|---|

| License Tier 1 | $29 |

| License Tier 2 | $99 |

| License Tier 3 | $199 |

Limitations Financial Fusion

While Financial Fusion presents a range of useful features, it has its limitations. One notable shortcoming is the restricted availability of certain advanced features in the lower tiers. Users seeking comprehensive functionalities may need to invest in higher-tier packages, which can significantly increase costs.

In addition, some users have reported that the user experience can be less intuitive compared to other competitive products. This may stem from an interface that, while functional, may not prioritize ease of navigation. User feedback frequently suggests that simplifying the interface could improve overall satisfaction.

On top of that, Financial Fusion may lack integration with some third-party applications that are commonly used in financial management. This aspect could restrict users who rely on multiple tools for their financial processes. Ensuring compatibility or providing alternative solutions to integrate with popular applications would be beneficial for users.

Case Studies

Exploring real-life examples can provide valuable insight into how Financial Fusion performs in practice. One user, a small business owner, utilized Financial Fusion to streamline their financial tracking processes. They reported achieving better visibility over their cash flow, leading to more informed decision-making for their business.

Another case involved a freelance consultant who relied on Financial Fusion to manage client billing. By leveraging the invoicing features, they were able to automate their billing processes, resulting in timely payments & improved cash flow management. This automation allowed them more time to focus on servicing clients rather than managing invoices manually.

A financial advisor incorporated Financial Fusion into their practice to offer clients enhanced reporting features. They found that the analytical tools enabled them to provide tailored insights, fostering deeper client relationships. This real-world implementation highlights how Financial Fusion’s features can lead to tangible business benefits.

Recommendations for Financial Fusion

To maximize the benefits of Financial Fusion, users can consider a few actionable recommendations. First, taking full advantage of available resources, such as tutorials & community forums, can greatly enhance user knowledge & comfort with the software. Getting involved in user communities can also provide support & additional tips.

Secondly, users should regularly review their financial needs. Since Financial Fusion allows for tier adjustments, users should remain proactive in ensuring that they are on the most suitable plan as their financial management requirements grow or change. This flexibility is one of the key advantages of this software.

Finally, pairing Financial Fusion with complementary tools can enhance overall functionality. Exploring integrations with additional software systems like CRM tools or tax software can streamline processes & improve efficiency. This interconnected approach can vastly improve financial management effectiveness.

- Utilize tutorials & community forums

- Review & adjust financial needs regularly

- Explore complementary tool integrations

- Automate invoicing & billing processes

- Monitor updates & feature releases

Advanced Usage Tips for Financial Fusion

Implementing advanced strategies can further enhance user experience with Financial Fusion. One suggestion is to use the software’s analytical tools to create personalized reports that provide deeper insights into financial performance. This can significantly aid in effective planning & forecasting.

Another tip involves setting up notifications for key financial milestones. Staying informed about deadlines or significant metrics can assist users in maintaining better control over their financial operations.

Lastly, consider frequent engagement with updates & training opportunities. The financial landscape continually evolves, & keeping abreast of new features can help users leverage Financial Fusion to its maximum potential. Staying educated on best practices & emerging financial technologies will contribute to better overall results.

| Advanced Usage Strategies |

|---|

| Create personalized reports |

| Set up key milestone notifications |

| Engage with training & update opportunities |

- Explore new features regularly

- Connect with other users for best practices

- Utilize data visualization tools

- Conduct periodic performance reviews

- Adjust settings based on user feedback

User Feedback

User feedback provides a wealth of insight into Financial Fusion’s performance. Many users express satisfaction with the product’s reliability & cost-effectiveness, particularly appreciating the lifetime access feature that protects their investment against rising costs.

Be that as it may, some users have voiced concerns regarding the learning curve associated with utilizing more complex features. Suggestions to alleviate this challenge emphasize enhancing support channels, such as live chat or improved tutorial content.

Ultimately, the consensus reflects a positive perception of Financial Fusion with room for improvement, particularly in terms of user support & ongoing education for users seeking to maximize their experience.

What is the Financial Fusion Lifetime Deal?

Financial Fusion is a comprehensive financial management tool that offers a lifetime deal allowing users to access its features & services without recurring fees. This deal aims to provide all-encompassing solutions for budgeting, investment tracking, & financial planning.

What features does Financial Fusion provide?

Financial Fusion includes various features like budgeting tools, investment tracking, expense management, & reporting. It also offers resources for financial literacy, helping users make informed financial decisions.

Is the Financial Fusion Lifetime Deal worth the investment?

The worth of the Financial Fusion Lifetime Deal depends on individual financial needs & goals. For those who seek long-term financial management tools without ongoing costs, this deal might be a valuable investment.

Are there any limitations to the Financial Fusion Lifetime Deal?

While the Financial Fusion Lifetime Deal offers extensive features, potential users should review the specifics of included services carefully. Certain advanced features or updates may not be included, so understanding the full scope is essential before committing.

Can I get support with Financial Fusion?

Yes, Financial Fusion provides customer support to assist users with any questions or issues. This support is essential for maximizing the tool’s effectiveness & addressing any concerns that may arise during usage.

Conclusion

In summary, the Financial Fusion Lifetime Deal offers an exciting opportunity for anyone seeking to build their financial future. With its easy-to-use platform & valuable resources, many users find it beneficial. Be that as it may, it’s important to evaluate whether it aligns with your personal financial goals before jumping in. If you’re ready to take your finances seriously, this deal could be worth your investment. Just make sure to do your research & assess your needs. Overall, the Financial Fusion Lifetime Deal Review suggests that it might be a smart choice for those looking to enhance their financial knowledge.